Presented by:

NIWA Minerals Connect

Mission:

To facilitate seamless transactions between small-scale miners and investors in the minerals industry

Vision:

To become the leading global facilitator of ethical and sustainable mineral investments, with a particular focus on the small-scale and artisanal sector

A Comprehensive Overview of Gold Purchasing in Tanzania

This guide provides essential information for investors and businesses interested in purchasing gold in Tanzania. It covers gold specifications, sourcing processes, pricing structures, payment terms, logistics, and regulatory compliance requirements, clearly outlining the necessary steps and considerations for engaging in legitimate gold transactions within Tanzania’s regulatory framework.

Gold Purchasing Guide

Essential information for investors and businesses interested in purchasing gold in Tanzania.

- Logistics & Sourcing Processes

- Pricing Structures, Payment terms

- Regulatory compliance requirements

Licensing Options

Necessary licensing options for engaging in compliant gold transactions.

- Broker License for local purchases

- Dealer License for buying, selling, and exporting minerals

Regulatory Framework

Considerations for operating within Tanzania’s regulatory framework.

- Legal Requirements & Due Diligence

- Proper procedure and documentation

- Adherence to KYC / AML Frameworks

Gold Specifications

Gold from small to medium-scale miners in Tanzania generally maintains an average purity of 90%. The gold is typically available in the form of gold bars or nuggets, making it suitable for various commercial purposes.

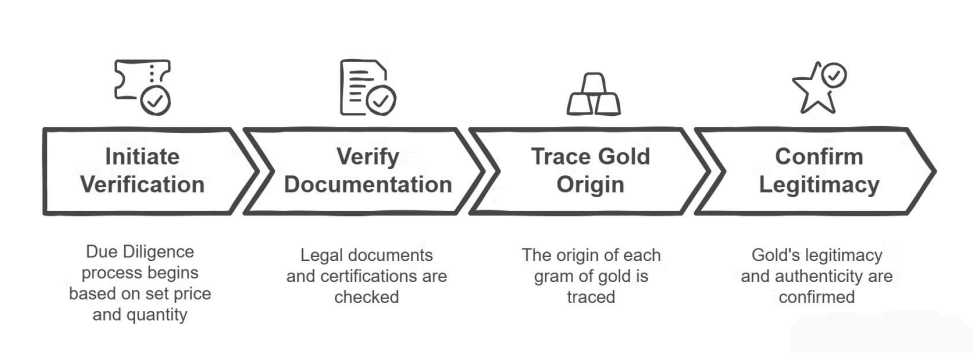

Prior to any transaction, the Tanzanian government conducts thorough due diligence procedures to verify the legitimacy and authenticity of the gold. This includes verification of legal documentation, certifications, and tracing the origin of each gram to ensure compliance with regulatory standards.

Gold Sourcing

The gold supply chain in Tanzania operates through a structured network of key stakeholders ensuring transparency and

regulatory compliance.

Government-Registered Gold Brokers

Licensed brokers form the initial link in the supply chain, collecting gold from miners across Tanzania.

Reputable Dealers

Authorized dealers purchase gold from brokers and facilitate both domestic and international transactions.

Ethical Artisanal Miners

Small-scale miners practicing responsible mining techniques serve as the primary source of gold in the supply chain.

Bank of Tanzania Rates

Daily rates established by the Bank of Tanzania govern all transactions, ensuring fair pricing throughout the supply chain.

This structured approach ensures transparency throughout the supply chain while maintaining compliance with national regulations governing mineral trade.

Gold Sourcing

Supply Chain Structure

Traceability

Verification Process

Note: Last step should be purity determination document through form of document from government.

Verification: Before any transaction takes place, the government conducts thorough due diligence to ensure the legitimacy and authenticity of the gold. This involves verifying legal documentation, certifications, and tracing the origin of each gram of gold.

The final step of the verification process is purity determination which occurs in the form of an assay report provided by officials in the mineral trading center.

Licensing Requirements – Dealer

Dealer License

For those intending to buy, sell, and export minerals, a Dealer License is required.

These licenses require at least 25% Tanzanian ownership, ensuring local participation in the mineral trade. The annual fee for a gold dealer’s license is approximately $1,200.

Dealers operate with prices approximately 10% below the Bank of Tanzania indicative price, creating their profit margin within the value chain.

Licensing Requirements – Broker

Broker License

Individuals or companies seeking to buy minerals locally can obtain a Broker License, which permits purchasing from miners within Tanzania.

The annual fee for a gold broker license is approximately $250, making it accessible for smaller-scale operations.

Brokers typically sell to dealers at prices approximately 10% below the dealer price, creating a structured margin within the supply chain.

Both license types are subject to regulatory oversight to ensure fair practices and compliance with Tanzanian mining laws.

The licensing structure facilitates proper tracking and taxation of gold throughout the supply chain, from miners to exporters

Pricing Structure in the Tanzanian Gold Market

The Tanzanian government establishes a daily Gold Indicative Price for certified gold dealers, typically set at approximately 10% below the London Bullion Market Association (LBMA) price. This pricing structure creates a cascading system of discounts through the supply chain.

Though the price may at times be represented in USD, BOT prices are generally represented in TZS equivalent on the day of, as all mineral market transactions within Tanzania occur in TZS.

- Bank of Tanzania (BOT) Price

BOT makes its purchases as per the LBMA spot price on the given trading day. - Dealers Price

Dealers have access to a 10% discount premium on the BOT Price - Brokers Price

Brokers have access to a 20% discount premium on the BOT Price

To remain competitive in the market, serious buyers should stay informed about daily price fluctuations by consulting the Bank of Tanzania Official Sites. Final pricing remains subject to market conditions and negotiation between parties.

Taxation and Export Fees

Government fee on mineral extraction

Covers official verification processes

Administrative service charge

Tanzania Revenue Authority taxation

Before exporting gold from Tanzania, dealers, buyers, or miners must pay a total of 9.3% in combined taxes and fees.

Additionally, exporters must obtain an Export Permit costing $100 USD and a Tanzania Revenue Authority release order at $150 USD. Shipment costs vary depending on the destination and logistics agency used.

These fees ensure compliance with Tanzanian regulations and contribute to government revenue from the mining sector. Proper budgeting for these costs is essential when calculating potential returns on investment in Tanzanian gold.

Consignment Tax Summary

Inspection Fee: 1%

Royalty: 6%

Subtotal Deductions (Export): 7%

Royalty: 4%

Subtotal Deductions (BOT): 4%

Service Levy: 3%

Applies to the entire transaction

Total Deductions Summary

Export Portion (80%) Total Deductions: 7% + 0.3% = 7.3%

BOT Portion (20%) Total Deductions: 4% + 0.3% = 4.3%

Deductions: 11.6% of consignment Value

Payment Terms

Payment Options

Parties involved in gold transactions typically discuss suitable payment terms that provide security and convenience for both sides.

The most common payment method is bank transfers, though other mutually agreed-upon methods may be utilized depending on the specific circumstances and preferences of the parties involved.

For significant transactions, buyers often establish escrow arrangements or utilize trusted third-party services to ensure security and verification before completing payment. This helps mitigate risk for both parties in high-value gold transactions.

Strategic Business Model

Securing substantial quantities of gold in Tanzania typically requires direct sourcing from miners. Many dealers aim to export gold to maximize profit margins, creating a competitive environment for purchasing directly from the source.

Due to this competition, dealers often sponsor miners’ daily operating costs, establishing agreements that miners will sell their acquired gold to these sponsors at discounted prices. This business model provides serious buyers with a strategic advantage and facilitates more efficient gold collection from multiple small-scale operations.

Logistics and Shipment Procedures

Once gold reaches the final entity (dealer), it undergoes official sealing with government documentation before being securely packaged for transit. Dealers typically arrange for reliable shipping methods, including insured courier services or trusted transportation companies. The shipment cost is the responsibility of the buyer, who should factor this expense into their overall acquisition budget.

Compliance and Legal Considerations

Required Documentation

All gold transactions must be supported by certificates of origin, export licenses, and assay reports to ensure compliance with both national and international regulations.

Anti-Money Laundering Procedures

Rigorous adherence to antimoney laundering (AML) procedures is mandatory, promoting transparency and integrity in every transaction within Tanzania’s gold market.

Know-Your-Customer Requirements

All parties must comply with know-your-customer (KYC) protocols to verify the identity and legitimacy of individuals and organizations involved in gold transactions.

Tanzania maintains strict regulatory oversight of its gold market to prevent illegal mining, smuggling, and money laundering. Compliance with these regulations is not merely recommended but required for all legitimate participants in the market. Failure to adhere to these requirements can result in significant legal penalties and forfeiture of assets.

Market Strategies for Effective Gold Purchasing

Successful gold purchasing in Tanzania requires a strategic approach that combines market knowledge with relationship building. Buyers who develop strong networks with miners and provide operational support gain preferential access to gold supplies. This approach creates mutual benefits, as miners secure needed operating capital while buyers establish reliable supply channels.

Prospective buyers should also consider regional variations in mining activity throughout Tanzania, as different areas may offer varying quantities, qualities, and pricing structures based on local conditions and accessibility.

Conclusion

This comprehensive overview provides essential guidance for navigating the gold purchasing processes in Tanzania. Understanding the regulatory framework, pricing structure, and operational considerations is crucial for successful participation in this market.

As Tanzania continues to develop its mining sector, opportunities remain for investors who approach the market with proper preparation and compliance.

The gold supply chain in Tanzania is structured to ensure traceability, fair pricing, and regulatory compliance. By following the guidelines outlined in this document, investors and businesses can engage in legitimate gold transactions while contributing to the formal economy of Tanzania.

Contact Information

For further assistance or clarification on any of the matters discussed in this guide, please feel free to reach out to us at info@niwa.ltd